AI Projects

Challenges

High Operational Costs: Outsourcing AML investigations is expensive, requiring substantial financial resources to manage and coordinate external analysts.

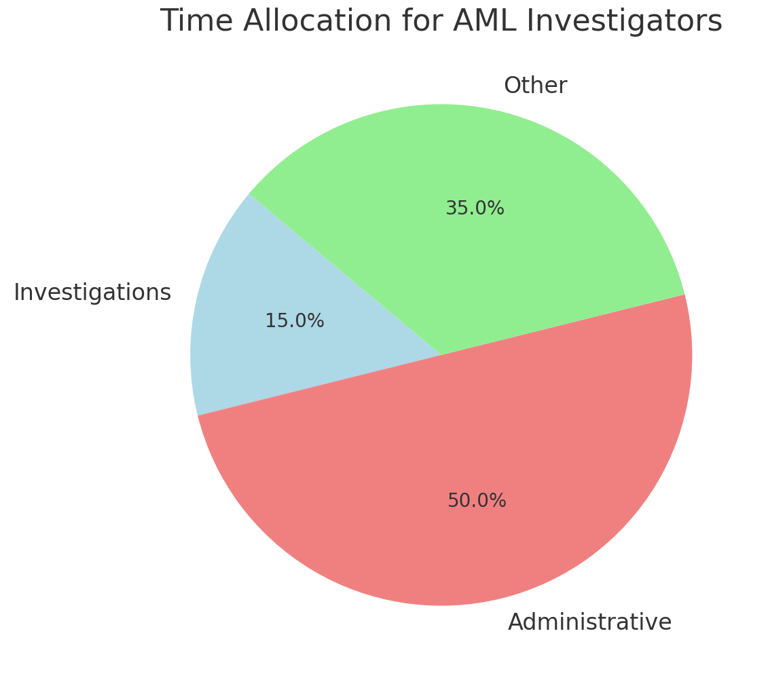

Inefficient Use of Time: AML investigators spend a majority of their time on non-investigative tasks, reducing their efficiency and productivity.

Backlogs and Compliance Risks: Delays in processing AML alerts can result in growing backlogs, increasing the risk of non-compliance and potential fines.

Latest Trends and Techniques

1. AI-Driven Automation

The integration of Artificial Intelligence (AI) agents in AML processes is a growing trend. AI agents, equipped with Large Language Models (LLMs), can automate routine tasks, reducing the workload on human investigators.

2. Multi-Source Data Integration

Modern AI systems leverage over 200 data sources to analyze and act on false positives, investigate high-risk clients, and create audit-ready narratives. This multi-source integration ensures comprehensive and accurate analysis.

3. Real-Time Monitoring and Escalation

AI agents operate 24/7, continuously monitoring for suspicious activities. They can escalate cases to full-time employees for further investigation, ensuring that critical decisions remain under human control.

Solution:-

Cgrad's AI Agents provide a comprehensive solution by learning the alert review process and working continuously to handle basic Know Your Customer (KYC) and AML tasks. Here’s how it works:

Choose where you need to supplement your staff: Identify the areas within your compliance operations that require additional support.

Add your policy, data sources, and inaccuracy thresholds: Customize the AI agents to align with your specific policies and data sources, and set thresholds for acceptable inaccuracies.

Review escalated cases: Focus on high-risk and escalated cases that require human judgment and decision-making.

Schedule a demo: See firsthand how Cgrad's AI agents can enhance your compliance operations.

Key Benefits

Higher Quality and Transparency: AI agents provide consistent and transparent reviews, ensuring higher quality in AML processes.

Significant Cost Savings: Automated systems reduce the need for expensive human reviewers, leading to significant cost savings.

Scalable Compliance Operations: Near-instant compliance capacity allows your team to focus on high-priority initiatives, unlocking growth opportunities.

Operational Efficiency

Chart 1: Time Allocation for AML Investigators

This chart illustrates the percentage of time spent on various tasks by AML investigators, highlighting the inefficiencies in the current system.Explanation: AML investigators spend only 15% of their time on actual investigations, with the remaining time consumed by administrative and non-investigative tasks.

Cost Comparison

Chart 2: Cost Comparison of Human vs. AI-Driven AML Investigations

This chart compares the operational costs of traditional human-based AML investigations with AI-driven approaches.Explanation: AI-driven approaches significantly reduce costs compared to traditional human-based methods.

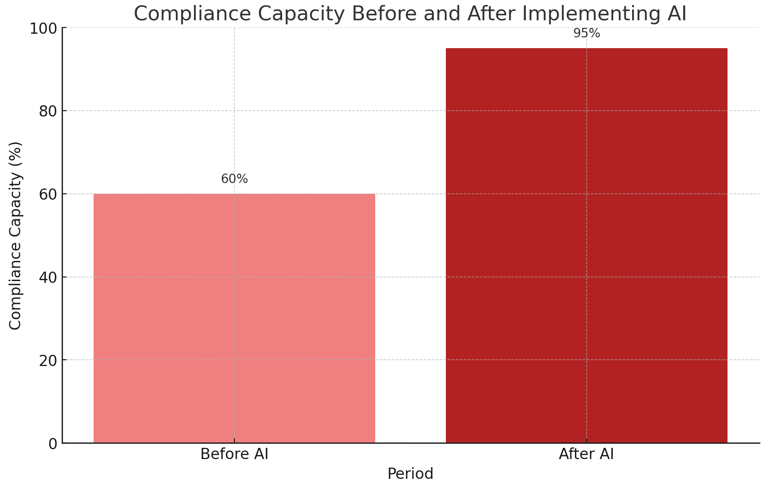

Compliance Capacity

Chart 3: Compliance Capacity Before and After Implementing AI

This chart shows the compliance capacity of a fintech company before and after implementing Cgrad's AI agents.Explanation: Implementing AI agents leads to a dramatic increase in compliance capacity, allowing for more efficient handling of AML tasks.